hello world

Discover the Top Recommended Games for Indian Players on Betmaster: Your Ultimate Gaming Guide

Top Recommended Games for Indian Players on Betmaster

Exploring the vibrant world of online gaming can be exhilarating, especially for Indian players who are seeking new and exciting platforms to showcase their skills. Betmaster, a renowned name in the online gaming industry, offers a plethora of gaming options tailored for enthusiasts from India. For a comprehensive overview, make sure to check out our detailed BETMaster review, which covers all aspects of this popular site.

Why Choose Betmaster?

Betmaster has carved a unique niche among gaming platforms due to its seamless user experience and extensive game selections. One of the key reasons Indian gamers are drawn to Betmaster is its dedication to providing localized gaming solutions, making it easier for players to navigate and enjoy their favorite games.

Top Games Recommended for Indian Players

1. Cricket Betting

Cricket holds a special place in the hearts of Indians, and Betmaster https://www.betmasterplay.net/hi/

accommodates this passion by offering a comprehensive cricket betting platform. Players can engage in live betting, pre-match betting, and take advantage of various promotional offers centered around major cricket events.

2. Teen Patti

Teen Patti, or Indian Poker, is a popular card game that has been digitized by Betmaster. With both multiplayer and single-player modes, this game remains a favorite for many Indian users who enjoy strategic and luck-based challenges.

3. Online Slots

For those who enjoy a mix of luck and quick wins, online slots provided by Betmaster are perfect. The site offers a variety of themes and styles, ensuring that every spin is as thrilling as the last.

Exclusive Features for Indian Players

- Localized Payment Methods: Supports UPI, Net Banking, and popular e-wallets for convenient transactions.

- Customer Support: Dedicated support for Indian players to assist with queries around the clock.

- Bonuses and Promotions: Tailored bonuses that cater specifically to Indian festivities and events.

Security and Fair Play

Betmaster prioritizes the security of its players. The platform features state-of-the-art encryption technologies to keep personal and financial data safe. Additionally, games are audited for fairness, ensuring a secure and transparent gaming environment.

Conclusion

Betmaster stands out as a top choice for Indian players interested in a diverse range of gaming opportunities. With its focus on Indian-friendly options, reliable security measures, and a broad game selection, Betmaster continues to attract a growing audience of Indian gaming enthusiasts. Therefore, it is highly recommended to explore Betmaster and take advantage of its offerings designed specifically for Indian audiences.

Frequently Asked Questions (FAQ)

1. What is the minimum deposit required to play games on Betmaster?

The minimum deposit varies depending on the payment method, but it generally starts from a very accessible range which aligns with local preferences.

2. Can Indian players access Betmaster on mobile devices?

Yes, Betmaster offers a highly responsive mobile platform accessible through both iOS and Android devices, allowing players to enjoy gaming on the go.

3. Are there any exclusive bonuses for new Indian users on Betmaster?

Yes, new users from India are often eligible for exclusive sign-up bonuses and promotions that enhance their initial gaming experience.

4. How can players withdraw their winnings from Betmaster?

Players can easily withdraw their winnings using a variety of methods tailored to Indian users, such as UPI, e-wallets, and direct bank transfers.

5. Does Betmaster provide live sports betting options?

Absolutely, Betmaster offers comprehensive live sports betting options, covering a wide array of sports popular among Indian fans.

6. What languages are supported on Betmaster for Indian users?

Betmaster supports several local languages, making it easier for Indian players to navigate and make the most of their gaming experience.

Frequently Asked Questions: Everything You Need to Know About Megapari Casino in India

Frequently asked questions about Megapari Casino in India

For those looking to learn more about the casino landscape, https://megapari.ind.in is a crucial resource that provides insights about Megapari India, its offerings, and more.

What is Megapari Casino?

Megapari Casino is an online gaming platform that offers a wide variety of casino games, sports betting options, and other gambling-related activities. It is popular among Indian players for its diverse gaming portfolio and user-friendly interface.

Is Megapari Casino legal in India?

The legality of online gambling in India varies by state. However, many international platforms like Megapari Casino operate under international licenses, allowing Indian users to register and play on their sites within jurisdictions where gambling is permitted.

How to register at Megapari Casino India?

Registering at Megapari Casino is straightforward. Simply visit their official website, click on the registration button, and fill in the required details such as your email address, phone number, and preferred currency. Ensure your information is accurate to facilitate smooth transactions and communication.

What payment methods are available?

Megapari Casino offers a variety of payment methods suitable for Indian players, including:

- Credit/Debit Cards (Visa, MasterCard)

- NetBanking

- UPI

- Paytm

- Skrill

- Cryptocurrencies like Bitcoin

Are there bonuses for new players at Megapari?

Yes, new players are often eligible for attractive bonuses, including welcome bonuses, free spins, and deposit matches. It’s advisable to check the promotions section on the Megapari website for the latest offers and terms and conditions.

How secure is playing at Megapari Casino?

Megapari Casino uses advanced encryption technology to ensure the safety of their players’ data and transactions. Additionally, they comply with international gambling regulations to provide a secure and fair gaming environment.

What games can I play at Megapari Casino?

The casino offers a wide array of games, including:

- Slots

- Table games like Blackjack, Roulette, Baccarat

- Live dealer games

- Sports betting

- Poker

What is the customer support like at Megapari Casino?

Megapari offers 24/7 customer support through various channels including live chat, email, and telephone. Their responsive team ensures players receive timely assistance with their queries or issues.

Can I play games in Indian Rupees at Megapari Casino?

Yes, Megapari Casino supports multiple currencies, including Indian Rupees, making transactions and gameplay convenient for Indian users.

Frequently Asked Questions

- Can I set limits on my gambling activities? Yes, Megapari allows users to set deposit limits, loss limits, and time restrictions to promote responsible gaming.

- Do I need to verify my account? Yes, account verification is necessary to ensure security and compliance with legal standards. Players need to provide identity proof and address documentation.

- Is there a mobile app for Megapari Casino? Yes, Megapari offers a mobile app available for both Android and iOS devices, providing a seamless mobile gaming experience.

- How do I withdraw my winnings? Withdrawals can be made through the payment methods available on the platform. Ensure your account is verified to avoid any delays.

- Are there any live dealer games? Yes, Megapari Casino offers a variety of live dealer games that simulate the real-life casino experience.

- What languages are supported at Megapari Casino? The platform supports multiple languages, including English, Hindi, and more, catering to a diverse user base.

- Is there a loyalty program? Yes, Megapari Casino offers a loyalty program that rewards frequent players with exclusive bonuses and promotions.

Conclusion

Megapari Casino provides a comprehensive gaming experience for Indian players, with its wide range of games, secure platform, and supportive customer service. Whether you are a seasoned gambler or a beginner, the casino offers something for everyone.

“`

Key Differences: Home Loan Top-Up vs Balance Transfer

Home loan is a great resource that comes in handy when you need financial aid in building the home of your dreams. There are several different types of home loans that can help you achieve that dream. In this guide, we’ll focus on two types of home loans, home loan top-up and balance transfers.

Both home top-up loan and balance transfer, have their aspects. Top-up loans can make your budget bigger to meet extra expenses, but home loan balance transfer is better for your pocket, it helps in lowering your interest rate.

Find The Right Option Between Home Loan Top-up And Balance Transfer

Here is an article highlighting the key differences between both options to help you decide which is best.

About Home Loan Top-Up

A home loan top-up is a way for banks and financial institutions to help home buyers in addition to the principal loan they are already taking out to secure a new home loan.

A wide range of loan amounts and loan tenures are available from different lenders.

To receive the top-up loan, the borrowers can use a balance transfer to obtain the loan from either their current or a different lender.

About Home Loan Balance Transfer

Balance transfers (BT) are credit facilities that allow you to move your existing home loan balance to a new lender.

It is often driven by better loan terms from a different lender, such as lower interest rates, longer terms of repayment, lower processing fees, etc that motivates the borrower to take a loan from them.

In times of crisis, this option can help reduce your EMI, or in other words, how much interest you have to pay as a whole.

Differences Between The Home Loan Top-Up And Balance Transfer

Following the discussion of home top-up loans and balance transfers, let’s move on to determine the difference between the two and the best option.

About

Top Ups are additional loans over current loans, and a borrower can take out a top-up loan from either their existing lender or another.

Balance transfers are credit transfers from one financial institution to another where the interest rate is higher than the current rate.

Purpose

Top-ups for home loans are helpful for a variety of reasons. Since they do not have any end-use restrictions, they could be used to fund a wedding or a college education.

The balance transfer of a home loan will entail you transferring the outstanding balance from one lender to another so you can get a better interest rate which can only be used when paying off your home loan.

Tenure

A top-up loan is often done much more quickly, but it is only available for the duration of the loan.

Despite the longer processing time, balance transfers will significantly reduce repayment terms.

EMI

The interest rate on a Balance Transfer will be lower than that you paid before, so that you will spend less on interest each month.

On the other side, the loan lenders offer to top up your loan at the same rate you are paying on the running loan. If you have a loan and a loan top-up, each of the EMIs must be paid separately.

Availability

Normally, a balance transfer can be done on a home loan once you have made 12 payments.

Once the loan is repaid, you can get a top-up loan, and it’s only available if the borrower doesn’t default.

Amount

For a top-up loan, the amount cannot exceed 70-75% of the sum obtained if the outstanding loan balance is subtracted from the estimated market value of your property.

A home loan balance transfer may be permitted when the property’s value does not exceed 80 to 90 percent of the loan balance.

Eligibility criteria for a home top-up loan

- You can apply for a top-up loan three months after your home loan disbursement. As long as you have paid three EMIs on your existing home loan, most financial institutions will approve you for a top-up loan of Rs. 1 lakh.

- To sanction a top-up loan, it is necessary to check the applicant’s repayment history associated with their existing home loan.

Eligibility criteria for a balance transfer

- Your current home loan with your present lender can only be switched for a better ROI after successfully paying 12 EMIs.

- Construction or renovations shouldn’t be taking place on your property.

We have already seen the key difference between the two, now let’s focus on one of the essential similarities between these two distinct loan types. Keep in mind, when you are considering getting either a home loan balance transfer or home loan top-up, your credit score will be an important factor that lenders will consider as part of the loan application process. A good credit score can increase your chances of getting approved for a balance transfer and may also result in a lower interest rate. On the other hand, a low credit score may lead to a higher interest rate or even a rejection of your loan application. It’s important to check your credit score and take steps to improve it before applying for a home loan balance transfer.

Also Read: How Do You Get a Home Loan With a Low CIBIL Score?

Find The Right Option Between Home Loan Top-up And Balance Transfer

Conclusion

When choosing between a balance transfer loan and a top-up loan, you must consider your own needs before choosing either.

There is also the option of transferring your loan to a new provider and taking advantage of a top-up loan. If the new lender has significantly reduced your loan’s interest rate, this will be a significant benefit for you as it will allow you to pay off your loan faster.

Wondering who can help you get the best home loans at a minimal rate? Then you should look for reputed Loan providers in Mumbai with a great track record. They’ll provide you with a home loan in Mumbai and give wings to the dream of building your own house.

Are you interested in learning about other types of home loans and what they entail? Then you should take a look at our in-depth guide covering 9 different types of home loans.

How to apply for a startup business loan in India?

Startups require more than a business product or service idea to bring their name to the market. Entrepreneurs’ lack of funding or capital is one of the greatest challenges they have to overcome to turn their idea into reality. It is also viable for startups to take out a business loan to expand their business.

We know how important funds are to keep the business running, particularly startups that don’t have backup

Ready to take your startup to the next level?

Apply for a startup business loan in India with ease!

To help you, we have compiled a comprehensive guide on how to get funding for startups.

Step-By-Step Instructions To Apply For Startup Business Loans

Here are 6 step processes to apply for the business loan for your startup business.

1. Draft a business plan

This document is a road map to your business’s success, including the business financing you’ll need. Many ways exist for you to help lenders evaluate your business, such as an outline of how you will fit into the market, attract customers, make money, etc., to see how your loan fits into your situation.

The lender is most interested in your working capital, market growth potential, and revenue plan. Keep this in mind because lenders are most concerned with your financial picture. You should write as much detail as possible to show that you will be a good borrower.

2. Choose the type of business loan

After completing your business plan, you are embarking on the next step to prove to potential lenders that you will be a great borrower. It’s time to decide which financing options for startups you apply for. After all, wouldn’t you like to ensure you can meet the loan terms. Startups have many options for business loans.

Traditional loans through a bank are more likely to offer you the best rates if you qualify.

In contrast, traditional bank loans are hard to qualify for startups. If you cannot borrow from your bank, consider an online lender, which is a good alternative.

3. Check your credit score

Lenders evaluate applicants’ credit scores to determine whether they represent a high or low risk. Higher credit scores are a better indicator of people who are more likely to pay on time and, consequently, have higher chances of being approved. In most cases, credit scores are seen as available within six months to one year after a business has been opened, so a new business may not have one, especially if it is a brand-new business.

However, it is important to remember that loans are often guaranteed by the borrower, meaning that if the business cannot repay the loan, the borrower will be liable to repay it with their funds. Therefore lenders also look at the credit score of the applicant/business owner personally.

It is important that before you apply for a loan, you review your business credit report and check your credit score so that you can be prepared for the loan application process and gauge your chances of being approved.

4. Make a list of lenders and compare them

Depending on your personal and business qualifications, a startup loan may be available through various lenders. When searching for a startup business loan that fits your needs, then take into consideration the following factors when comparing lenders:

- Rates on an annual basis

For the most part, business loans start at around 9% APR, though business startup loans may have higher APRs, and rates may be even lower for the most qualified applicants for business loans. Find out what the APR of each lender is by visiting the lender’s website or by contacting their customer service department.

- Fees and other costs

There are typically origination fees charged by business lenders that range from 3% to 5% of the loan amount, which covers the costs associated with handling paperwork and verifying the application information provided by the applicant.

As well as prepayment penalties, some lenders charge late payment fees to borrowers who miss their monthly payment deadline and prepayment penalties to those who pay off their loans early.

As a result, these fees can increase the cost of borrowing, which is why some lenders remove them to stay competitive.

- Lender reputation

The most important thing to remember when looking for a lender is to read reviews online about the lender, no matter how good it appears on paper.

Similarly, you should contact other business community members to find out about their experiences with the financial institution before deciding.

If you encounter any red flags in your research, such as negative experiences with their customer service department, consider choosing another lender.

5. Prepare the list of documents required

Depending on the lender, the documents required to apply for a business loan may vary. While the majority of lenders use some documents to assess and verify an applicant’s identity, as well as the existence of a business, there are some documents that they always require.

As a startup founder, you can enhance your chances of acceptance by drafting a comprehensive business plan. Based on the revenue and expense projections for the future, this can serve as a useful tool for lenders to demonstrate the business’s financial stability.

In addition, lenders may also request that you submit copies of licences and registrations relating to your business, industry, or product, as well as banking information, so that direct deposits can be made.

6. Submit

When deciding on a lender, ensure you are familiar with the application process and have gathered the correct documentation before applying.

There is a difference in the application and underwriting process between lenders, so check with them whether you can apply online, via telephone, or if you must visit a branch.

A lender representative may contact you after you submit your application to obtain additional documentation, such as proof of collateral or financial records, which may be required for the loan application.

Are you interested in learning the steps of applying for business loan without ITR? Then you can refer to our detailed guide: How to Apply for a Business Loan without ITR?

Also Read: 9 Different Types Of Business Loans In India

Ready to take your startup to the next level?

Apply for a startup business loan in India with ease!

Conclusion

It may seem daunting to find financing for your newly established business. But if you have a detailed plan, you will be in a better position to apply for a loan, choose a loan that fits your needs, and follow a payment schedule. You can take your startup to great heights with the help of the much-needed funding you receive.

Still, if you can’t approve the loan, we at Real Money Solutions can assist you in getting the loan for a small business in Mumbai.

Primary Differences Between Cash Credit And Overdraft

As a business owner, you must be aware that several factors contribute to the smooth functioning of your business operations and ensure your business’s success. Capital is the most significant factor among all the factors responsible for keeping a business running smoothly. To run a successful daily operation, both small and medium businesses need access to a certain amount of capital from time to time. Even though there are several ways for a business to procure capital, cash credit, and overdraft facilities are the most popular.

The problem is that most people tend to confuse them or think they are the same thing.

Unsure of the difference between Cash Credit and Overdraft?

Let us help you make the right choice for your financial needs!

This guide will help you determine the difference between an overdraft and cash credit to make a more informed decision about your business.

A] What Is Cash Credit?

A Cash Credit (CC) loan is offered to self-employed professionals and business owners to ensure they can pay their operational expenses.

B] What Is Overdraft?

The bank provides its customers with an overdraft (OD) credit facility. With the OD facility, current account holders can withdraw money from their bank accounts regardless of their balance, even if it is extremely low.

OD against FD is a common type of overdraft facility that allows customers to borrow against their fixed deposits held with the bank.

C] Primary Differences Between Cash Credit And Overdraft

When it comes to the financial needs of your business, you should always choose the right solutions including credit facility. Choosing the right credit facility is imperative to manage your business affairs effectively.

Understanding the difference between OD and CC can significantly change the odds in your favour.

| Parameters | Cash Credit | Overdraft |

| Purpose | The cash credit loan facility is a good way for businesses to obtain working capital when required. | The overdraft facility allows individuals and businesses to meet short-term financial obligations. |

| Basis | An organisation’s stocks and inventories determine whether it can get a cash credit loan. | The overdraft facility provided by a bank is governed by the applicant’s relationship with the bank (such as the investments, the type of account they hold, etc.) |

| Interest rate | There is a lower interest rate on cash credit than on overdrafts | It is necessary to open a new account to receive the cash credit loan amount. |

| Set up an account. | It is necessary to open a new account to receive the cash credit loan amount. | No need to create a new account. Since overdrafts are available to existing customers. |

| Duration of the loan | The repayment period for a cash credit loan is usually one year. | The repayment tenure for overdraft facilities is usually available every month, every quarter, on a half-yearly basis, or an annual basis. |

| Loan Amount | Throughout this financing agreement, the sanctioned amount does not decrease. | Overdraft amounts decrease monthly on overdraft facilities. |

This is a more detailed explanation of how they differ.

1. The Purpose Of Financing

There is a considerable difference between cash credit and overdraft that is centred on the purpose of each of them. It is important to note that a cash credit option is only available to businesses to meet their working capital requirements.

As opposed to this, funds obtained through overdrafts are not restricted in terms of how they can be used. Therefore, it can be used for personal and professional purposes to finance your needs.

2. Loan Amount Availability

In the case of a cash credit that is available in exchange for the hypothecation of inventory, the loan amount that can be obtained entirely depends on the amount of stock the business has maintained when the loan is requested.

There is no set amount you can borrow for an overdraft facility. In many cases, you can borrow a certain amount depending on your credit history and your past relationship with the bank. It is, therefore, the point at which overdrafts in banks are distinguished from cash credit in banks.

As far as overdraft facilities are concerned, the number of funds you can avail of will be directly related to the value of the asset you will be using as collateral to provide security for the overdraft facility.

3. Withdrawal facilities

Among the other significant differences between overdraft vs cash credit accounts is the withdrawal facility they offer, which is provided for both accounts. The cash credit option allows you to receive funds at a time following the approved amount. In contrast, the overdraft facility allows you to withdraw funds in multiple amounts based on the total amount available.

D] Are there any similarities between cash credit and overdraft?

Yes. Despite their differences, cash credit and overdraft facilities do share some similarities. And while it is essential to understand the difference between the two, let’s not overlook the similarities, they are just as crucial.

1. The Maximum Amount

It should be noted that the maximum sanctioned amount under both financing arrangements is fixed and that further financing cannot be approved.

2. Repayment

Cash credit loans and overdraft facilities are repayable on demand, whether based on a credit card or a bank account. The prepayment fees for these two types of financing options do not apply to either of them.

Unsure of the difference between Cash Credit and Overdraft?

Let us help you make the right choice for your financial needs!

Conclusion

We hope that we have cleared up any confusion you had regarding cash credit and overdraft. Similarly, if you have trouble understanding the difference between overdraft and business loan, You can refer to our guide: Understanding Business loan vs. Overdraft: Which to choose?

Moving on, for small businesses concerned about short-term financial pressures, overdrafts, and cash credit are great alternatives to meeting those pressures. In contrast, if you seek a long-term business loan to cover your current business needs, consider applying for one.

If you’re starting a new business or thinking of expanding your existing business taking it to new heights, you may require some monetary help. This is where loan agencies come in handy. You can look for reputed Loan Consultants in Mumbai. They can help you find loans suitable for your business needs.

We guarantee you will not have to cut back on essential expenses by providing a competitive business loan rate. We also offer services for business loan Mumbai. You can always feel free to reach out to us and we can assist you in your objective to grow your business, helping you reach new heights of success!

How to get a Business Loan under CGTMSE Scheme without Collateral?

Founded in 2000 by the Small Industries Development Bank of India and the MSMEs, the Credit Guarantee Fund Trust is an initiative of the Government of India to provide credit guarantees to micro and small-sized businesses.

Those startup companies need funds to gain a strong foothold in the market. Collateral-free loans under CGTMSE scheme act as guarantors for business loans, helping business owners get financing.

To understand and benefit from the CGTMSE loan for new business, every entrepreneur and business owner in India must understand its importance. The availability of investment capital, whether debt or equity, is crucial for a company to launch and manage successfully, and the CGTMSE scheme has made it easier to access financing.

We will explore the CGTMSE Scheme, loan types, and how business loans can be obtained.

Don’t let a lack of collateral hold you back from growing your business.

Our team of experts can help you understand the eligibility criteria and guide you through the application process.

A] About CGTMSE

The government of India has established the CGTMSE program to provide guarantees to micro and small enterprises to facilitate their access to banks so they can start up financially sustainable businesses.

The scheme allows first-generation entrepreneurs to achieve their entrepreneurial goals through a credit framework. Further, this facility facilitates a smooth flow of funds to MSEs by reinforcing the credit funding mechanism.

The Credit Guarantee Trust’s responsibility is to recover the lender’s loss up to 85%, depending on the extent of the failure, if an MSE fails to meet its obligations. The program does not fund business startups involved in retail, trade, agriculture, education, or self-help organizations.

B] Features of CGTMSE

The CGTMSE Scheme has the following features:

- Selected banks and NBFCs are eligible for the guarantee cover.

- Working capital and term loans are both considered.

- A maximum of INR 2 Crores in credit facilities is available to new and existing MSEs.

- The guarantee coverage offered by CGTMSE is up to 75%-85%.

- The scheme covers manufacturers and service providers.

- RBI guidelines set interest rates.

- Lenders may lend Rs.1 crore to revive the business units if they cannot recover independently.

- If the credit was not recovered within three months or when the loan became non-performing, whichever came first, then CGTMSE would cover the entire loan amount, including interest.

C] Steps To Apply For A Business Loan Under The CGTMSE Scheme

The following steps must be followed to get a loan under the CGTMSE Scheme without any collateral security:

1. Understand the business entity

Suppose you are planning to apply for a CGTMSE loan for new business. In that case, you must set up a Private Limited Company, Limited Liability Partnership, One Person Company, or Proprietorship as per the business needs and acquire the necessary tax registrations and approvals to undertake business or execute projects.

2. Create a business plan

A market assessment should be done, and a business plan or project report should be prepared with information such as the business model, promotion profile, projected financials, etc.

Professionals with prior experience must prepare a business plan or a project report for “making the CGTMSE scheme a successful one,” where banks should place a high priority on project viability or business model validation and secure the loan facility without any collateral requirements.

3. Get authorisation for a bank loan

To get bank loan sanction under the CGTMSE Scheme, the business plan or project report should be submitted to the necessary banks that provide loans under the Scheme. The banks providing loans under the Scheme would then approve the loan request.

Bank loans can include terms and working capital facilities when a request is made for a bank loan. A loan application will be processed and sanctioned according to the bank’s policies.

4. Get a CGTMSE cover

When the Bank has sanctioned the bank loan, it will apply to the CGTMSE organization and acquire cover for the sanctioned Collateral-free loans under CGTMSE scheme. It is required that the borrower pay the CGTMSE service fee and the CGTMSE guarantee fee when the CGTMSE organization approves the loan.

If you are having difficulties understanding the application process, you can get in touch with reputed loan agents in mumbai. An experienced loan provider agency will have a good grasp of the process and can help understand the process swiftly.

D] Types of CGTMSE Schemes

1. Credit Guarantee Schemes For Banks

As part of its policy, the Ministry of Micro and Small Enterprises has proposed to grant guarantees to MSEs regarding credit facilities they receive from lending institutions. As a result of streamlining the scheme’s operation and thereby increasing credit flow to MSEs, several amendments have been made to keep up with the requirements of the banks and MSEs.

Based on CGTMSE’s ‘Hybrid Security’ policy, CGTMSE’s guarantee cover applies to the portion of the credit facility which is not protected by collateral security, the part not covered by the collateral security of CGTMSE.

To resolve the credit problem, lending institutions can often obtain collateral security on only a part of their credit facility, what is known as fractional collateral security. It may be possible to cover the outstanding amount through the Credit Guarantee Scheme.

As a result, CGTMSE will charge a fee on the credit facility’s principal and collateral security.

2. Credit Guarantee Fund Scheme For NBFCS

The CGTMSE developed a scheme for NBFCs to provide credit to MSEs. Towards a maximum of Rs. 2 crores, MLI will cover all loans it extends to MSE-eligible borrowers with a trust fund that will cover them all. Retail traders of MSEs have access to a maximum credit coverage of Rs. 1 Crore. Following Reserve Bank of India instructions, the fund should not be used for personal purposes.

Also Read: Top 8 Government Loan Schemes for Small Businesses in India

Don’t let a lack of collateral hold you back from growing your business.

Our team of experts can help you understand the eligibility criteria and guide you through the application process.

Conclusion

Start-ups and established MSMEs can benefit from loans for MSMEs loan without collateral in many ways. As a result, if you are looking for an MSME loan, you will not be required to provide any collateral or security. There is no need to pledge your assets if you are starting up a business or expanding an existing business.

Get in touch with us if you wish to apply for a business loan Mumbai, and we would be happy to assist you.

6+ Different Types of Unsecured Business Loans

A business’s growth depends heavily on a continuous flow of funds. This flow is crucial to closing deals, purchasing assets, expanding the business, paying the workforce, etc.

It may be easier for a large company to obtain these funds, whereas, for a small company, it may not be as easy if it cannot secure collateral to receive the cash. This is where unsecured business loans for startups come into the picture.

As the name suggests, this type of funding is offered by banks that do not require the applicants to provide any collateral to them. Business loans are unsecured loans based on an applicant’s financial record, credit score, income, and other factors.

Unlock the potential of your business with an Unsecured Business Loan!

Our informative guide sheds loans in the different unsecured loan types. They can help keep your business operations moving forward.

About unsecured business loan

One important thing to know about unsecured business loans is that they require no security, and the borrower’s assets do not secure an unsecured loan; instead, it is approved by the lender based on the borrower’s creditworthiness.

Term loans, consolidation loans, and working capital loans, are the three most common types of unsecured loans in India.

Also Read: 9 Different Types Of Business Loans In India

6+ Types of unsecured loans

Unsecured business loans can be divided into several types, and they are all popular among entrepreneurs. Before choosing which option is best for you, it is essential to understand what each option entails.

1. Revolving credit

This type of loan has a revolving credit limit, the total credit limit that the borrower can borrow at any given time.

A borrower can withdraw the maximum of their aggregate capital throughout a specified period; the period can be one month, three months, six months, or any other specified period they choose. During the interim, the borrower will have the opportunity to repay the amount partially or totally and withdraw again within the predetermined limits.

If the borrower does not return the amount within the specified period, they will have to repay the amount and any interest calculated on the amount withdrawn. Typically, revolving loans are credit cards.

2. Term loans

The term loan is an unsecured loan in which the borrower receives a lump sum amount and is required to repay the loan in fixed instalments over the loan’s term until it is fully repaid at the end of the loan period.

Most individuals choose to take out a loan for a long-term investment or to buy a fixed asset to make capital investments.

Generally, these loans have fixed interest rates and are available for a specified period.

3. Consolidation loan

A consolidation loan is another unsecured loan issued to borrowers who wish to pay off pre-existing debts, such as credit cards or other unsecured debts.

4. SBA Loan

Small business loans, offered by the Small Business Administration (SBA), have become increasingly popular for small businesses in the past few years due to their attractive terms, such as low-interest rates & even more extended repayment periods, when compared to the other types of loans.

The SBA makes loans to businesses in some cases without requiring collateral, but in most cases, they are secured loans. A personal guarantee is sometimes required even when collateral is not required. Still, a personal guarantee is more than likely necessary for your company to qualify for an SBA loan.

5. Merchant Cash Advance

When a lender offers a merchant cash advance, you can get a lump sum from them in return for a percentage of future sales. If you need cash fast, this may be a good option for you to consider, and it would be a great way to reduce the debt on your business in the future.

However, it can be tricky to determine how much repayment your business will have to make to the lender. In such a case, your company will be responsible for repaying the original amount to the creditor, including interest. With high-interest rates, you may find that the percentage is higher than you anticipated.

6. Working Capital Loan

Working capital loans are particularly useful for new businesses in that may have limited cash flow to cover their day-to-day expenses. A working capital loan for a new business in India can provide much-needed liquidity to help the business cover its operating costs and grow. These loans typically have short repayment terms and may be secured or unsecured, depending on the lender’s requirements and the borrower’s creditworthiness.

7. Overdraft

Overdrafts are a type of loan or credit limit offered by lenders, which can be borrowed in instalments. The interest on the overdraft is calculated based on the amount used or borrowed from the assigned credit limit.

These overdrafts are often secured with collateral or securities, such as fixed deposits, property, LIC policies, or securities. This collateral provides lenders with a level of protection in case the borrower is unable to repay the loan.

By providing access to short-term financing, overdrafts can be a helpful tool for managing cash flow and supporting businesses’ financial needs.

Eligible criteria for an unsecured business loan

Listed below are the eligibility criteria for unsecured business loans:

- When you apply for the loan, you must be 18 or older, and when the loan matures, your age must be 65.

- You need to have credit scores of at least 750 to qualify.

- The company should have a minimum of one year of profitable operations operated from the same location as the previous year.

- Payslips must demonstrate a steady source of income for the applicant.

- An up-to-date bank statement or information about your bank account.

Also Read: Key Differences between Secured and Unsecured Business Loans

Unlock the potential of your business with an Unsecured Business Loan!

Conclusion

If your business requires a loan without security then an unsecured business loan is the most suitable option available as of today. Unsecured loans are especially great for small businesses, learn why with our detailed guide: Why are Unsecured business loans better for small businesses?

Generally, unsecured loans have fewer complications and are processed faster than unsecured loans, making the process simpler and quicker.

The loan can be obtained in a matter of days, and there is less risk for the borrower since there are no security requirements. It is normal for an unsecured business loan to be offered based on your credit history; in this way, you would easily be able to obtain one.

Are you interested in procuring unsecured business loans in Mumbai so that you can get your business up and running? Then you should get reputed loan agents in mumbai to assist you in getting business loans so that your daily business operations are not disrupted.

Understanding Tax Benefits on Home Loans & How to Claim Them

The government of India aims to provide its masses with a myriad of income tax benefits on home loans, making it possible for all citizens to enjoy the dream of home ownership. The most significant benefit of owning a home is that the loan you take out for the house comes with several tax advantages.

In order to obtain home loan tax benefits people have to start by making wise investments. The tax benefits associated with home loans represent a long-term investment that provides you with tax breaks for a longer period. Under Section 80C of the Indian Revenue Code (IRC), a home loan may be eligible for a tax deduction.

To encourage its citizens to buy a home, the Indian government offers tax savings on home loans. In this article, we discussed the tax benefits of home loans and how you can claim them.

Unlock the Full Potential of Your Home Loan: Learn How Tax Benefits Work and Claim Them Today to Maximize Your Savings!

6 Types Of Tax Deductions on Home Loan

According to an announcement made by the Union Minister of India in 2020-21, there would be an extension of income tax rebates for home loans until 2024, ensuring both new and existing income tax rebates on home loans would continue to be available during this period.

Home loan tax deductions fall into the following categories:

1. Deduction on Home Loan Interest Rates during Pre-construction Phase

Section 24b allows you to claim home loan benefits in income tax on the interest you pay. This interest can be claimed during the pre-construction phase. If you applied for a home loan while your property was being constructed and accumulated interest rates during this phase, it’s possible for you to deduct this interest through five equal instalments.

2. Deduction on the repayment of the principal loan amount

Your EMI payment includes two components: the principal amount and the interest amount. Section 80 C of the Income Tax Act of 1961 allows you to deduct the principal payment on an EMI if you own a self-occupied property. The property you own in which your parents reside or in which you live can also be considered self-occupied.

Tax deductions of up to 1.5 lakh are on principal payments made in EMIs for two houses purchased with home loans. If you rent out the second house you own, that is considered a let-out property, which would still qualify you for the home loan tax benefit. Additionally, you can claim your stamp duty and registration fees.

3. Deduction on the payment of interest

The home loan interest tax exemption also counts as a tax deduction. A taxpayer who owns and occupies a self-occupied home can claim a tax benefit on loan payments up to 2 lakhs under section 24 of the Income Tax Act. A person who owns a second house for which they want to take advantage of the home loan deduction cannot allow themselves to deduct more than two lakhs in a financial year.

When renting a property, there is no maximum limit on interest claims. However, the loss you can claim under the Income from House Property tax return is limited to a maximum of Rs 2 lakhs. If you have any remaining loss, you can carry it forward for eight years so that it can be adjusted against your income from house properties.

4. Additional deduction under section 80EE

The benefits for this deduction can be claimed by home owners whose loan was sanctioned between 1st April 2016 to 31st March 2017. You can not only claim a tax deduction of Rs. 2 lakh for interest paid under section 80EE, but might also get to claim a further deduction of Rs. 50,000 if you meet their criteria. We have listed two primary criteria below.

- Property worth at least Rs. 50 lakhs should be pledged as collateral for the loan, which cannot exceed Rs. 35 lakhs.

- The deduction is only available to first-time home buyers and residential properties.

5. Extra deduction under section 80EEA on an affordable house

Similar to 80EE, the benefits of 80EEA can be claimed by home owners who submitted their loan application between April 1, 2019, and March 31, 2022. If you are paying home loan interest, you can claim an additional deduction of Rs. 1.5 lakh on your income tax return. According to Section 80EEA of the IRC, to qualify for the home loan tax credit, you must meet a certain set of requirements listed below:

- In the case of residential property, a stamp value of 45 lakhs should be the maximum.

- You must be a first-time homebuyer on the approval date to be approved for the loan.

- This section is not applicable if you are eligible for deduction under section 80EE.

The government makes frequent amendments to the Section 80EE and 80EEA. So, you’ll need to check with official websites such as income tax India and MCA Gov website.

6. Deductions on joint home loans

A joint home loan will allow each borrower to claim a deduction at the time of repayment for repayable interest up to 2 lakhs, under Section 24(b), and a deduction at the time of principal repayment up to Rs. 1.5 lakh under Section 80C. Compared to a home loan based on a single applicant, this increases the number of deductions available. Both applicants will be considered co-owners if they own the property and pay the EMIs.

Does this information make you want to check your credit scores so that you can claim these tax benefits on home loans? Then our informative guide on Credit Scores for home loans should prove to be useful.

Also Read : 9 Different Types of Home Loans You Should Know About

How to claim home loan tax benefits?

It is easy to claim tax benefits on a home loan. Follow the steps below to claim your deduction.

- Decide on the tax deduction you will claim.

- The property must be yours, or you must be a co-borrower.

- The home loan interest certificate should be provided to your employer as a source adjustment for tax deductions.

- Unless you follow the previous step, you must file your tax return.

- A self-employed person doesn’t need to submit these documents anywhere. It would be best to keep them on hand for future concerns from the income tax department.

Unlock the Full Potential of Your Home Loan: Learn How Tax Benefits Work and Claim Them Today to Maximize Your Savings!

Conclusion

Potential home buyers can save a lot of money when they take advantage of income tax rebates on their home loans. With the extensive scope of the exemption on housing loans discussed above, it is an excellent idea, even from an investment point of view, to purchase a new home.

Here at Real Money Solutions, we have a team of the most efficient home loan agents in Mumbai that can guide you in finding the best home loan at the right interest rate for your needs.

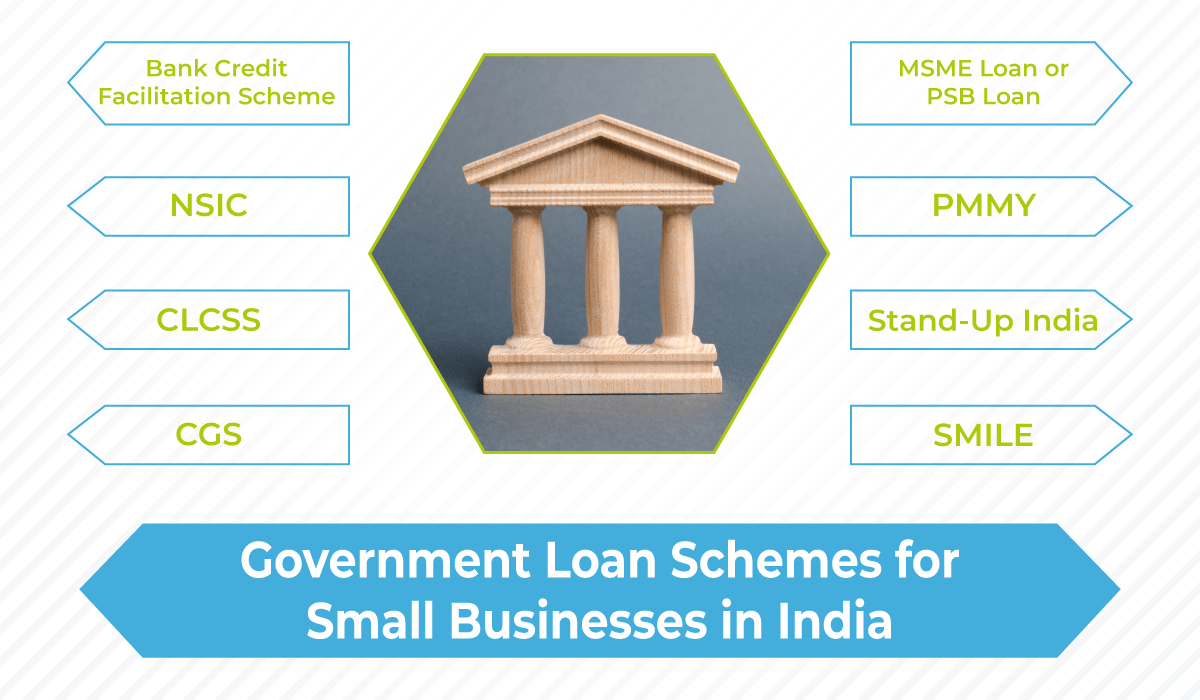

Top 8 Government Loan Schemes for Small Businesses in India

Whether you are thinking of starting a business on your own or expanding the existing one, a constant cash flow is something you will need. In this case, business loans can come to the rescue, and a business loan can help you secure the necessary funding for starting or expanding your business.

Since the demand for business loans has increased in India, the government has launched several subsidy and government loan schemes aimed at helping the nation’s entrepreneurs operate small yet profitable companies while taking advantage of this increasing market. You can get in touch with experienced loan agents in Mumbai for guidance regarding such government backed loan schemes. They can help you find the right scheme for your business.

Meanwhile, you can refer to this guide. It can help you understand the different types of government loan for small businesses. We have also shared eligibility criteria for some of the loans for small businesses.

Empower Your Small Business: Explore Government Loan Schemes in India and Fuel Your Growth Today!

8 Types Of Government-Backed Loans Scheme for Small Business India

The government of India is making every possible effort to support all small businesses by launching a government loan scheme for businesses. Here are a few of the top govt loans for new businesses.

1. MSME Loan or PSB Loan

The Government of India has launched a policy to provide loans to MSME businesses so that they can take care of their working capital requirements. Under the MSME scheme, any business can apply for financial assistance up to Rs.1 crore for new or existing ventures, irrespective of whether they are new or existing. After the loan application is submitted, the loan processing usually takes 8-12 business days to complete. However, loan approval or disapproval usually occurs within the first 59 minutes of applying.

The applicant must have GST and IT and have a minimum of six months of bank history to qualify for this particular loan. To be eligible for participation, a company must meet the following criteria:

- Revenues/incomes

- Capacities for repayment

- Available credit facilities

- Anything else lenders (banks or NBFCs) set.

2. Pradhan Mantri MUDRA Yojana (PMMY)

Pradhan Mantri MUDRA Yojana (PMMY) is yet another central government loan scheme to meet the financial requirements of different sectors, business activities, and segments of businesses and entrepreneurs. Small businesses are generally eligible for loans up to Rs. 10 lakhs from banks without pledging collateral.

For the loan to be approved, you must be a member of the Non-Corporate Small Business Segment (NCSB), consisting of proprietorships and businesses in rural and urban areas.

3. National Small Industries Corporation (NSIC)

NSIC is an Indian government company that has been ISO-certified under the MSMEs category. To encourage and aid the growth of MSMEs, NSIC provides a wide range of financial, marketing, and technological services and other allied services to promote their growth.

With the help of this program, small and medium-sized businesses can receive assistance with Marketing Support, which is critical to their growth in this competitive market. In addition, MSMEs can take advantage of the Credit Support Scheme, which provides raw material procurement, marketing funding, and financing through syndication with banks to assist them in acquiring raw materials.

4. Credit Linked Capital Subsidy Scheme (CLCSS)

Currently, the Credit Link Capital Subsidy Scheme (CLCSS) offers a variety of low-cost loans and credits to small and medium enterprises as part of the government of India’s policy on providing loans and credits to small businesses.

The program has been designed to help small and medium-sized businesses to upgrade to the latest technology seamlessly and remain competitive in domestic and overseas markets by upgrading to the newest technology seamlessly. To enable MSMEs to use the latest technology, the Ministry provides loans up to Rs 15 lakh, which amounts to 15% of the overall expenditures incurred during the upgrade process.

5. Stand-Up India

The Stand Up India program is sponsored by the Small Industries Development Bank of India (SIDBI) and was introduced to provide finance to entrepreneurs who belong to SC/ST categories and to women entrepreneurs. As part of this scheme, at least one SC/ST borrower and one woman borrower per bank branch will be able to get a loan of up to Rs.1 crore.

To qualify for this scheme, enterprises engaged in trading, manufacturing, or service projects are considered eligible. An SC/ST or woman entrepreneur should hold at least 51% of a non-individual enterprise’s shareholding stake.

6. Bank Credit Facilitation Scheme

Aiming to meet the credit requirements of small and medium-sized enterprises (SMEs), NSIC is the organisation that is headed up this scheme. As part of the effort, the National Security Information Centre (NSIC) has agreed with several nationalised and private sector banks.

With the assistance of these banks and their syndication partners, the NSIC can provide credit support to small and medium enterprises (MSMEs) without any cost to them (fund- or non-fund-based limits). Indian-registered MSMEs are eligible to apply for this scheme.

7. Credit Guarantee Scheme (CGS)

Businesses can use this loan scheme to upgrade their technology. Using the funds, the company can revamp various aspects of the business, including the manufacturing process, marketing, and supply chain, to reduce the overall cost of creating and providing goods and services. This will result in a reduction in the production cost as a result. As part of the CLCSS, businesses eligible for the scheme are offered an up-front capital subsidy of 15%.

New and existing manufacturing/service MSMEs, excluding retail trade, educational establishments, agriculture, Self-Help Groups (SHGs), and training institutions

8. SIDBI Make in India Soft Loan Fund for MSMEs (SMILE)

SMEs seeking to expand or start up new businesses and existing businesses seeking financing can apply for a line of credit loan. It was launched in 2015 by the Small Industries Development Bank of India (SIDBI), a government entity that generates credit for small industries.

An essential objective of the loan program is to assist newly formed small companies in achieving a favourable debt-to-equity ratio. According to the SMILE program, the minimum amount that can be borrowed is INR 25 lakh. In addition, the loan has a repayment term of 10 years, which is a great benefit. MSMEs in 25 designated areas will receive low-interest financing in line with the Indian government’s “Make in India” initiative, and loans will be offered on a term basis for five years.

A wide range of companies, both new to the market and those in the existing manufacturing and service sectors, are eligible to apply for this scheme. Under this scheme, existing enterprises will also be covered in terms of upgrading their existing operations or launching projects that will allow them to grow their business. As a reminder, the maximum repayment period for the loan is ten years, with a grace period of 36 months.

Also Read: How to get a Business Loan under CGTMSE Scheme without Collateral?

Empower Your Small Business: Explore Government Loan Schemes in India and Fuel Your Growth Today!

Conclusion

We hope you have all the details about government schemes for small business loans. A business loan is a long-term loan with the lowest interest rate that can be obtained compared with other loans on the market. If you are interested in applying for a sme loans in mumbai through one of these programs, you should do so without any hesitation.