Business enterprises are built on the backbone of funding, and funding is required for every type and size of business to survive and prosper.

When you run a business in a dynamic environment today, you will often find yourself wondering and thinking of it as challenging to figure out how you will fund a particular need for your business. There’s one simple answer to your queries, business loans. Business loans are a significant source of funding. However, finding the right type of business loan is also quite essential.

Generally speaking, the type of business loan ideal for a given business depends on the factors such as:

- the type of assets purchased,

- the leasing of a factory or shop,

- the purchase of new machinery,

- the working capital requirements,

- basic operating expenses such as overhead and salaries, among others.

It is challenging to choose suitable business loans as they are multiple choices for every business. That is why it is essential to determine the type of loan best for you.

Also Read : Key Differences between Secured and Unsecured Business Loans

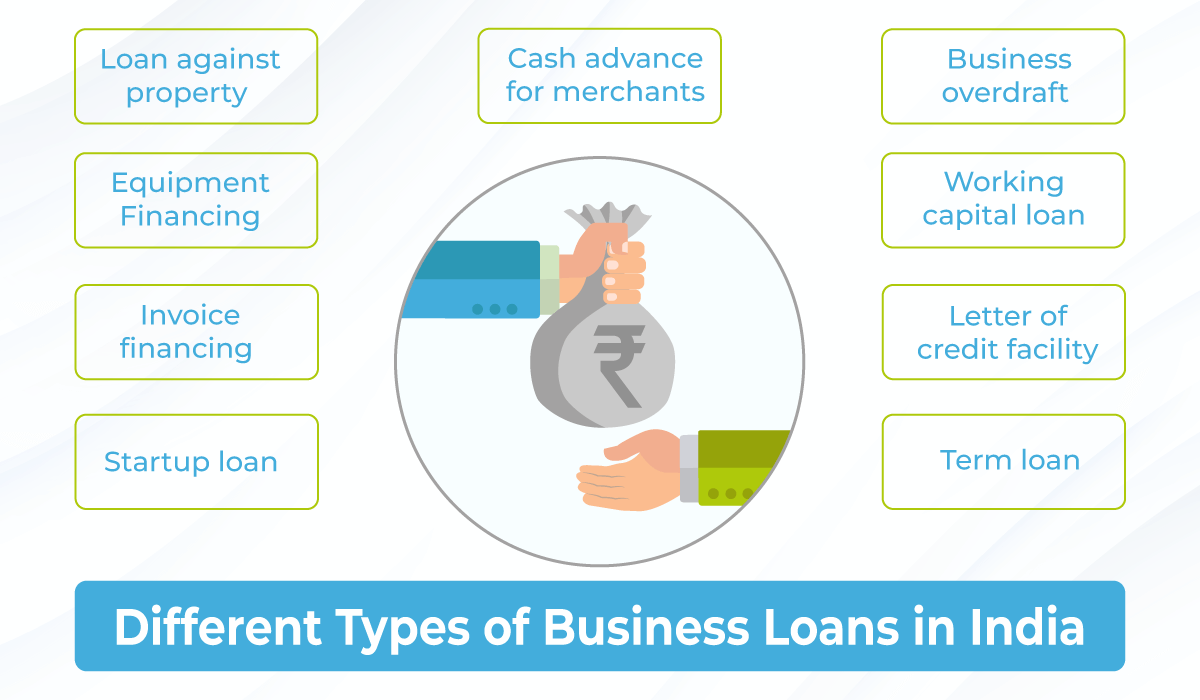

In this article, we have put together the different types of business loans in India.

Fuel Your Business Growth: Discover the Different Types of Business Loans Available and Find the Perfect Funding Option Today!

Types of business loans

Since business loans act as a backbone for every business looking to expand. Let’s have a glimpse at different types of business loans.

Businesses looking to expand tend to rely on business loans, which is why it’s crucial to understand the different types. So, let’s take a look at the 9 common types of business loans.

1. Startup loan

Start-up loans are intended for entrepreneurs planning to launch a new business venture. The applicants on this list do not have an excellent credit history, and their company does not have a track record of business performance.

As a result, when the lender assesses a business borrower’s eligibility for a business loan, they consider the borrower’s and company’s credit profile.

When determining the amount, term, and interest rate of a loan, lenders consider turnover figures and other financial facts and figures.

There is a requirement that the applicant must establish their business before they can apply for the loan. The applicant must submit proof of the existence and registration of the business at the time the application is submitted.

2. Term loan

Term loans are among the most common business loans types. It can be secured or unsecured and take many forms. The tenure of a secured loan is usually around 15-20 years; on the other hand, the tenure of an unsecured loan is generally between 1-5 years. An investment loan is a loan to finance a business’s capital expenditures and growth.

Depending on the financial history of the purchaser, the lender gives the purchaser a loan according to their requirements. Regarding the secured nature of this loan, it is backed by collateral and has either a floating or a fixed interest rate.

3. Equipment Financing

The equipment financial loans are also referred to as machinery loans and are used whenever it is necessary to borrow a large sum of money to purchase and use a little or a lot of equipment for your production. As the name implies, this type of loan is only to purchase machinery, and the loan is not counted towards the company’s growth for borrowing funds.

Whenever you take out a loan, you will need some form of security and collateral. Despite this, the interest rates on these loans are considerably lower than those on other types of loans, and the term of the loans ranges from roughly 1 to 3 years.

4. Loan against property

It is a business loan product that can provide you with a percentage of the value of your investments, such as stocks, insurance policies, fixed deposits, gold, mutual funds, etc. This type of loan can offer business owner’s up to 75% of the total investment value for the investment and does not require any other assets to be pledged as collateral for the loan.

5. Business overdraft

As a general rule, overdrafts are secured by securities or collateral, most commonly in the form of fixed deposits held with the financial institution.

An overdraft limit is approved once the lender has taken into account the credit history of the borrower, the institution’s relationship with the borrower, the business cash flow, and the borrower’s repayment history before approving the overdraft limit.

As long as the borrower takes out the amount he needs, interest is only charged on the amount withdrawn. It is permissible to use the funds in this manner as long as the principal and interest amounts are repaid according to the terms set by the lender.

6. Invoice financing

This loan can also be referred to as invoice factoring, and it is beneficial for small businesses that need a source of funding between the time they send out invoices and when they receive payments from clients. Lenders can lend up to 80% of the invoice based on the amount raised in the invoice; therefore, the amount that can be lent can be paid back over time.

Due to instant and constant cash flow, clients do not need to wait for invoices to be paid before receiving cash flow. This results in the loan repaying within a short period once the agreed repayment period and interest rate are met.

7. Working capital loan

This type of business loan is to cover business expenses on a day-to-day basis. It can be beneficial for the business to take out a working capital loan if they have several issues with their cash flow, purchasing additional inventory, managing their payroll, etc.

This type of business loan is short-term and meant to help meet your cash flow requirements if there is a delay between your payables and receivables, which can lead to an expansion of your cash flow requirements.

8. Cash advance for merchants

Here, a portion of the daily debit card sales or credit card sales is transferred directly to the financial institution as an advance on the money it has to cover its needs.

Due to this, the company must set aside a certain percentage of each day’s credit sales so the advance can be paid back over time. Enough money must be available in the borrower’s account to make the payments.

The person who receives a merchant cash advance only has to make payments based on the daily sales they make to make the payments.

As a result, you can pay back less money if the company is performing poorly, while on the other hand, you may be able to pay back more money if the company is performing well.

9. Letter of credit facility

Letters of credit are another kind of business loan frequently used in international transactions, such as import and export sales that take place on a global scale.

It is important to note here that buyers and sellers have bankers involved in the financial transaction.

The international buyer and seller are unknown to each other, so it becomes necessary to use a letter of credit to ensure the financial transaction is routed through the bankers of their respective countries. Hence, both parties have some sense of security that the transaction is being performed.

Also Read: 6+ Different Types of Unsecured Business Loans

Fuel Your Business Growth: Discover the Different Types of Business Loans Available and Find the Perfect Funding Option Today!

Conclusion

From startup loan to invoice financing, we have covered 9 different types of business loans, each of these loans come in handy in different scenarios. Emerging businesses can look into startup loans, whereas businesses looking to expand their services with new equipment can consider Equipment Financing options.

If you are considering getting an unsecured business loan, it is also necessary to look for reputed unsecured business loan providers in Mumbai or your nearby neighbourhoods. This ensures that the loan process goes through smoothly. Apart from business loans, Real Money Solutions also provides an extensive range of financial services to the citizens of mumbai.