As a business owner, you must be aware that several factors contribute to the smooth functioning of your business operations and ensure your business’s success. Capital is the most significant factor among all the factors responsible for keeping a business running smoothly. To run a successful daily operation, both small and medium businesses need access to a certain amount of capital from time to time. Even though there are several ways for a business to procure capital, cash credit, and overdraft facilities are the most popular.

The problem is that most people tend to confuse them or think they are the same thing.

Unsure of the difference between Cash Credit and Overdraft?

Let us help you make the right choice for your financial needs!

This guide will help you determine the difference between an overdraft and cash credit to make a more informed decision about your business.

A] What Is Cash Credit?

A Cash Credit (CC) loan is offered to self-employed professionals and business owners to ensure they can pay their operational expenses.

B] What Is Overdraft?

The bank provides its customers with an overdraft (OD) credit facility. With the OD facility, current account holders can withdraw money from their bank accounts regardless of their balance, even if it is extremely low.

OD against FD is a common type of overdraft facility that allows customers to borrow against their fixed deposits held with the bank.

C] Primary Differences Between Cash Credit And Overdraft

When it comes to the financial needs of your business, you should always choose the right solutions including credit facility. Choosing the right credit facility is imperative to manage your business affairs effectively.

Understanding the difference between OD and CC can significantly change the odds in your favour.

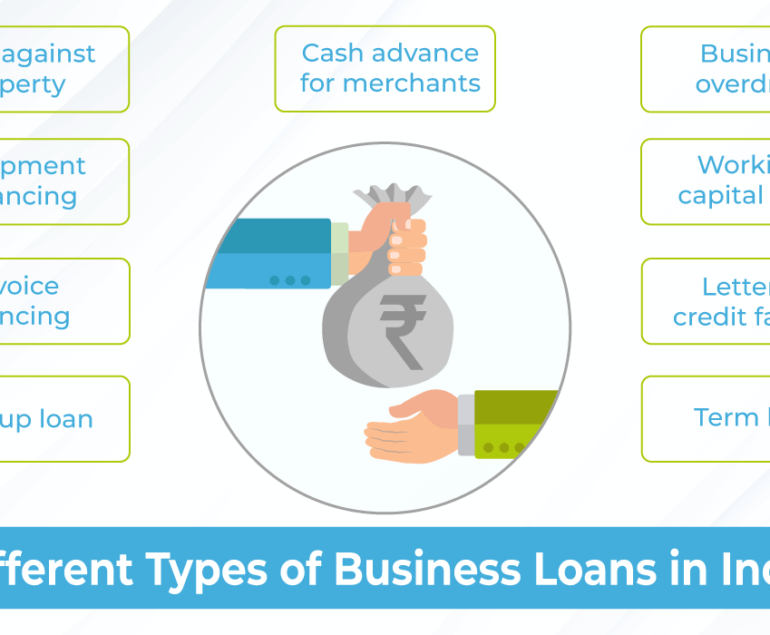

| Parameters | Cash Credit | Overdraft |

| Purpose | The cash credit loan facility is a good way for businesses to obtain working capital when required. | The overdraft facility allows individuals and businesses to meet short-term financial obligations. |

| Basis | An organisation’s stocks and inventories determine whether it can get a cash credit loan. | The overdraft facility provided by a bank is governed by the applicant’s relationship with the bank (such as the investments, the type of account they hold, etc.) |

| Interest rate | There is a lower interest rate on cash credit than on overdrafts | It is necessary to open a new account to receive the cash credit loan amount. |

| Set up an account. | It is necessary to open a new account to receive the cash credit loan amount. | No need to create a new account. Since overdrafts are available to existing customers. |

| Duration of the loan | The repayment period for a cash credit loan is usually one year. | The repayment tenure for overdraft facilities is usually available every month, every quarter, on a half-yearly basis, or an annual basis. |

| Loan Amount | Throughout this financing agreement, the sanctioned amount does not decrease. | Overdraft amounts decrease monthly on overdraft facilities. |

This is a more detailed explanation of how they differ.

1. The Purpose Of Financing

There is a considerable difference between cash credit and overdraft that is centred on the purpose of each of them. It is important to note that a cash credit option is only available to businesses to meet their working capital requirements.

As opposed to this, funds obtained through overdrafts are not restricted in terms of how they can be used. Therefore, it can be used for personal and professional purposes to finance your needs.

2. Loan Amount Availability

In the case of a cash credit that is available in exchange for the hypothecation of inventory, the loan amount that can be obtained entirely depends on the amount of stock the business has maintained when the loan is requested.

There is no set amount you can borrow for an overdraft facility. In many cases, you can borrow a certain amount depending on your credit history and your past relationship with the bank. It is, therefore, the point at which overdrafts in banks are distinguished from cash credit in banks.

As far as overdraft facilities are concerned, the number of funds you can avail of will be directly related to the value of the asset you will be using as collateral to provide security for the overdraft facility.

3. Withdrawal facilities

Among the other significant differences between overdraft vs cash credit accounts is the withdrawal facility they offer, which is provided for both accounts. The cash credit option allows you to receive funds at a time following the approved amount. In contrast, the overdraft facility allows you to withdraw funds in multiple amounts based on the total amount available.

D] Are there any similarities between cash credit and overdraft?

Yes. Despite their differences, cash credit and overdraft facilities do share some similarities. And while it is essential to understand the difference between the two, let’s not overlook the similarities, they are just as crucial.

1. The Maximum Amount

It should be noted that the maximum sanctioned amount under both financing arrangements is fixed and that further financing cannot be approved.

2. Repayment

Cash credit loans and overdraft facilities are repayable on demand, whether based on a credit card or a bank account. The prepayment fees for these two types of financing options do not apply to either of them.

Unsure of the difference between Cash Credit and Overdraft?

Let us help you make the right choice for your financial needs!

Conclusion

We hope that we have cleared up any confusion you had regarding cash credit and overdraft. Similarly, if you have trouble understanding the difference between overdraft and business loan, You can refer to our guide: Understanding Business loan vs. Overdraft: Which to choose?

Moving on, for small businesses concerned about short-term financial pressures, overdrafts, and cash credit are great alternatives to meeting those pressures. In contrast, if you seek a long-term business loan to cover your current business needs, consider applying for one.

If you’re starting a new business or thinking of expanding your existing business taking it to new heights, you may require some monetary help. This is where loan agencies come in handy. You can look for reputed Loan Consultants in Mumbai. They can help you find loans suitable for your business needs.

We guarantee you will not have to cut back on essential expenses by providing a competitive business loan rate. We also offer services for business loan Mumbai. You can always feel free to reach out to us and we can assist you in your objective to grow your business, helping you reach new heights of success!