Startups require more than a business product or service idea to bring their name to the market. Entrepreneurs’ lack of funding or capital is one of the greatest challenges they have to overcome to turn their idea into reality. It is also viable for startups to take out a business loan to expand their business.

We know how important funds are to keep the business running, particularly startups that don’t have backup

Ready to take your startup to the next level?

Apply for a startup business loan in India with ease!

To help you, we have compiled a comprehensive guide on how to get funding for startups.

Step-By-Step Instructions To Apply For Startup Business Loans

Here are 6 step processes to apply for the business loan for your startup business.

1. Draft a business plan

This document is a road map to your business’s success, including the business financing you’ll need. Many ways exist for you to help lenders evaluate your business, such as an outline of how you will fit into the market, attract customers, make money, etc., to see how your loan fits into your situation.

The lender is most interested in your working capital, market growth potential, and revenue plan. Keep this in mind because lenders are most concerned with your financial picture. You should write as much detail as possible to show that you will be a good borrower.

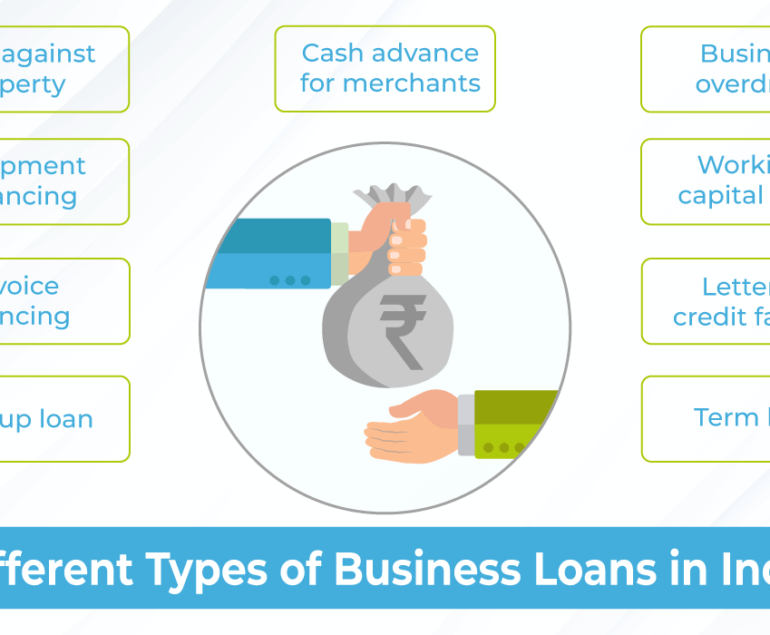

2. Choose the type of business loan

After completing your business plan, you are embarking on the next step to prove to potential lenders that you will be a great borrower. It’s time to decide which financing options for startups you apply for. After all, wouldn’t you like to ensure you can meet the loan terms. Startups have many options for business loans.

Traditional loans through a bank are more likely to offer you the best rates if you qualify.

In contrast, traditional bank loans are hard to qualify for startups. If you cannot borrow from your bank, consider an online lender, which is a good alternative.

3. Check your credit score

Lenders evaluate applicants’ credit scores to determine whether they represent a high or low risk. Higher credit scores are a better indicator of people who are more likely to pay on time and, consequently, have higher chances of being approved. In most cases, credit scores are seen as available within six months to one year after a business has been opened, so a new business may not have one, especially if it is a brand-new business.

However, it is important to remember that loans are often guaranteed by the borrower, meaning that if the business cannot repay the loan, the borrower will be liable to repay it with their funds. Therefore lenders also look at the credit score of the applicant/business owner personally.

It is important that before you apply for a loan, you review your business credit report and check your credit score so that you can be prepared for the loan application process and gauge your chances of being approved.

4. Make a list of lenders and compare them

Depending on your personal and business qualifications, a startup loan may be available through various lenders. When searching for a startup business loan that fits your needs, then take into consideration the following factors when comparing lenders:

- Rates on an annual basis

For the most part, business loans start at around 9% APR, though business startup loans may have higher APRs, and rates may be even lower for the most qualified applicants for business loans. Find out what the APR of each lender is by visiting the lender’s website or by contacting their customer service department.

- Fees and other costs

There are typically origination fees charged by business lenders that range from 3% to 5% of the loan amount, which covers the costs associated with handling paperwork and verifying the application information provided by the applicant.

As well as prepayment penalties, some lenders charge late payment fees to borrowers who miss their monthly payment deadline and prepayment penalties to those who pay off their loans early.

As a result, these fees can increase the cost of borrowing, which is why some lenders remove them to stay competitive.

- Lender reputation

The most important thing to remember when looking for a lender is to read reviews online about the lender, no matter how good it appears on paper.

Similarly, you should contact other business community members to find out about their experiences with the financial institution before deciding.

If you encounter any red flags in your research, such as negative experiences with their customer service department, consider choosing another lender.

5. Prepare the list of documents required

Depending on the lender, the documents required to apply for a business loan may vary. While the majority of lenders use some documents to assess and verify an applicant’s identity, as well as the existence of a business, there are some documents that they always require.

As a startup founder, you can enhance your chances of acceptance by drafting a comprehensive business plan. Based on the revenue and expense projections for the future, this can serve as a useful tool for lenders to demonstrate the business’s financial stability.

In addition, lenders may also request that you submit copies of licences and registrations relating to your business, industry, or product, as well as banking information, so that direct deposits can be made.

6. Submit

When deciding on a lender, ensure you are familiar with the application process and have gathered the correct documentation before applying.

There is a difference in the application and underwriting process between lenders, so check with them whether you can apply online, via telephone, or if you must visit a branch.

A lender representative may contact you after you submit your application to obtain additional documentation, such as proof of collateral or financial records, which may be required for the loan application.

Are you interested in learning the steps of applying for business loan without ITR? Then you can refer to our detailed guide: How to Apply for a Business Loan without ITR?

Also Read: 9 Different Types Of Business Loans In India

Ready to take your startup to the next level?

Apply for a startup business loan in India with ease!

Conclusion

It may seem daunting to find financing for your newly established business. But if you have a detailed plan, you will be in a better position to apply for a loan, choose a loan that fits your needs, and follow a payment schedule. You can take your startup to great heights with the help of the much-needed funding you receive.

Still, if you can’t approve the loan, we at Real Money Solutions can assist you in getting the loan for a small business in Mumbai.