Whether you are thinking of starting a business on your own or expanding the existing one, a constant cash flow is something you will need. In this case, business loans can come to the rescue, and a business loan can help you secure the necessary funding for starting or expanding your business.

Since the demand for business loans has increased in India, the government has launched several subsidy and government loan schemes aimed at helping the nation’s entrepreneurs operate small yet profitable companies while taking advantage of this increasing market. You can get in touch with experienced loan agents in Mumbai for guidance regarding such government backed loan schemes. They can help you find the right scheme for your business.

Meanwhile, you can refer to this guide. It can help you understand the different types of government loan for small businesses. We have also shared eligibility criteria for some of the loans for small businesses.

Empower Your Small Business: Explore Government Loan Schemes in India and Fuel Your Growth Today!

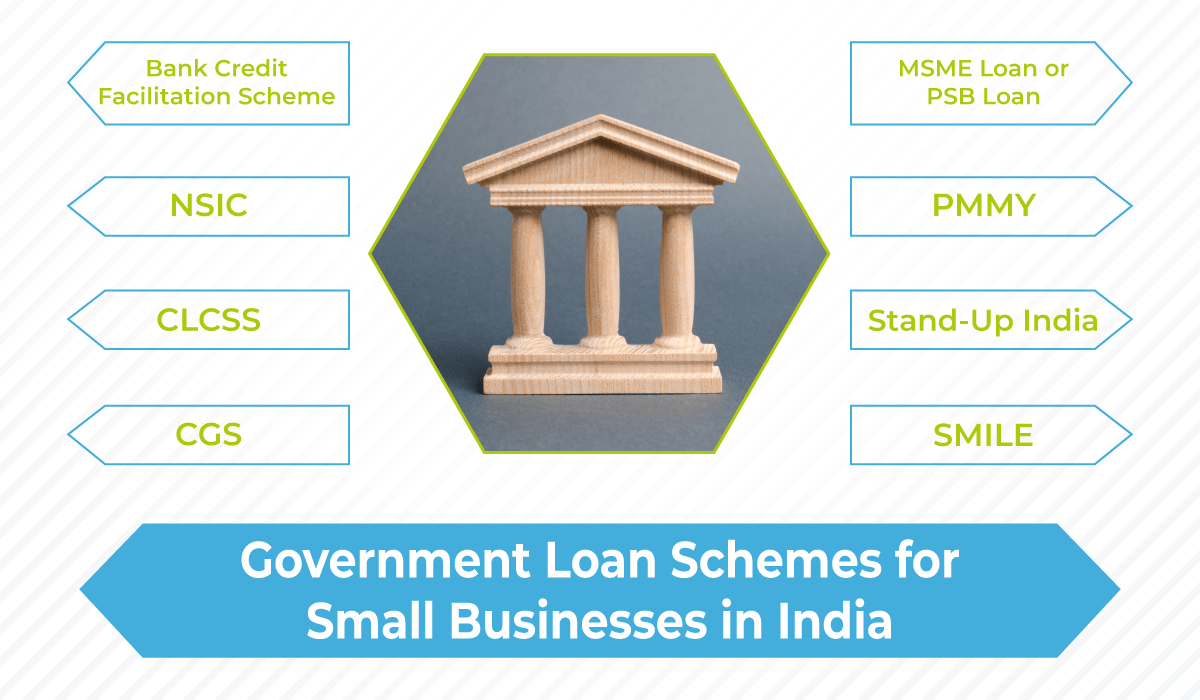

8 Types Of Government-Backed Loans Scheme for Small Business India

The government of India is making every possible effort to support all small businesses by launching a government loan scheme for businesses. Here are a few of the top govt loans for new businesses.

1. MSME Loan or PSB Loan

The Government of India has launched a policy to provide loans to MSME businesses so that they can take care of their working capital requirements. Under the MSME scheme, any business can apply for financial assistance up to Rs.1 crore for new or existing ventures, irrespective of whether they are new or existing. After the loan application is submitted, the loan processing usually takes 8-12 business days to complete. However, loan approval or disapproval usually occurs within the first 59 minutes of applying.

The applicant must have GST and IT and have a minimum of six months of bank history to qualify for this particular loan. To be eligible for participation, a company must meet the following criteria:

- Revenues/incomes

- Capacities for repayment

- Available credit facilities

- Anything else lenders (banks or NBFCs) set.

2. Pradhan Mantri MUDRA Yojana (PMMY)

Pradhan Mantri MUDRA Yojana (PMMY) is yet another central government loan scheme to meet the financial requirements of different sectors, business activities, and segments of businesses and entrepreneurs. Small businesses are generally eligible for loans up to Rs. 10 lakhs from banks without pledging collateral.

For the loan to be approved, you must be a member of the Non-Corporate Small Business Segment (NCSB), consisting of proprietorships and businesses in rural and urban areas.

3. National Small Industries Corporation (NSIC)

NSIC is an Indian government company that has been ISO-certified under the MSMEs category. To encourage and aid the growth of MSMEs, NSIC provides a wide range of financial, marketing, and technological services and other allied services to promote their growth.

With the help of this program, small and medium-sized businesses can receive assistance with Marketing Support, which is critical to their growth in this competitive market. In addition, MSMEs can take advantage of the Credit Support Scheme, which provides raw material procurement, marketing funding, and financing through syndication with banks to assist them in acquiring raw materials.

4. Credit Linked Capital Subsidy Scheme (CLCSS)

Currently, the Credit Link Capital Subsidy Scheme (CLCSS) offers a variety of low-cost loans and credits to small and medium enterprises as part of the government of India’s policy on providing loans and credits to small businesses.

The program has been designed to help small and medium-sized businesses to upgrade to the latest technology seamlessly and remain competitive in domestic and overseas markets by upgrading to the newest technology seamlessly. To enable MSMEs to use the latest technology, the Ministry provides loans up to Rs 15 lakh, which amounts to 15% of the overall expenditures incurred during the upgrade process.

5. Stand-Up India

The Stand Up India program is sponsored by the Small Industries Development Bank of India (SIDBI) and was introduced to provide finance to entrepreneurs who belong to SC/ST categories and to women entrepreneurs. As part of this scheme, at least one SC/ST borrower and one woman borrower per bank branch will be able to get a loan of up to Rs.1 crore.

To qualify for this scheme, enterprises engaged in trading, manufacturing, or service projects are considered eligible. An SC/ST or woman entrepreneur should hold at least 51% of a non-individual enterprise’s shareholding stake.

6. Bank Credit Facilitation Scheme

Aiming to meet the credit requirements of small and medium-sized enterprises (SMEs), NSIC is the organisation that is headed up this scheme. As part of the effort, the National Security Information Centre (NSIC) has agreed with several nationalised and private sector banks.

With the assistance of these banks and their syndication partners, the NSIC can provide credit support to small and medium enterprises (MSMEs) without any cost to them (fund- or non-fund-based limits). Indian-registered MSMEs are eligible to apply for this scheme.

7. Credit Guarantee Scheme (CGS)

Businesses can use this loan scheme to upgrade their technology. Using the funds, the company can revamp various aspects of the business, including the manufacturing process, marketing, and supply chain, to reduce the overall cost of creating and providing goods and services. This will result in a reduction in the production cost as a result. As part of the CLCSS, businesses eligible for the scheme are offered an up-front capital subsidy of 15%.

New and existing manufacturing/service MSMEs, excluding retail trade, educational establishments, agriculture, Self-Help Groups (SHGs), and training institutions

8. SIDBI Make in India Soft Loan Fund for MSMEs (SMILE)

SMEs seeking to expand or start up new businesses and existing businesses seeking financing can apply for a line of credit loan. It was launched in 2015 by the Small Industries Development Bank of India (SIDBI), a government entity that generates credit for small industries.

An essential objective of the loan program is to assist newly formed small companies in achieving a favourable debt-to-equity ratio. According to the SMILE program, the minimum amount that can be borrowed is INR 25 lakh. In addition, the loan has a repayment term of 10 years, which is a great benefit. MSMEs in 25 designated areas will receive low-interest financing in line with the Indian government’s “Make in India” initiative, and loans will be offered on a term basis for five years.

A wide range of companies, both new to the market and those in the existing manufacturing and service sectors, are eligible to apply for this scheme. Under this scheme, existing enterprises will also be covered in terms of upgrading their existing operations or launching projects that will allow them to grow their business. As a reminder, the maximum repayment period for the loan is ten years, with a grace period of 36 months.

Also Read: How to get a Business Loan under CGTMSE Scheme without Collateral?

Empower Your Small Business: Explore Government Loan Schemes in India and Fuel Your Growth Today!

Conclusion

We hope you have all the details about government schemes for small business loans. A business loan is a long-term loan with the lowest interest rate that can be obtained compared with other loans on the market. If you are interested in applying for a sme loans in mumbai through one of these programs, you should do so without any hesitation.